According to foreign news on April 17, the S&P Global Commodity Insights report shows that the risk of supply disruption and the downturn in downstream aluminum demand are expected to limit the global alumina price trend in the second quarter of 2023. Aluminum prices rose.

In the first quarter, supplies in the Pacific and Atlantic basins were disrupted due to force majeure at the Kwinana alumina refinery in Western Australia and a conveyor belt system failure at the Alumar refinery in Brazil.

Due to high energy costs, European aluminum smelting capacity, which was cut in 2022, has basically been offline, while China’s aluminum production has risen as domestic alumina production has increased. China’s new alumina smelting capacity and the closure of the arbitrage window also dampened China’s spot import demand in the first quarter.

Platts, a unit of S&P Global Commodity Insights, estimated that benchmark Australian alumina FOB was quoted at $355 a tonne on April 14, up from $330 a tonne at the start of the year but down from a year-to-date high of $371 a tonne hit in mid-February.

The market is divided on the impact of reduced supply and cost pressures

The market is divided on cost pressures and the impact of lower output from some Australian alumina producers.

Higher energy prices and rising raw material costs such as caustic soda and bauxite prices have been some of the key factors driving up operating costs for Australian alumina producers.

While Australia’s Worsley Alumina achieved a record high output in the 2022 fiscal year, other Australian alumina producers saw production decline during this period.

“Considering these factors, the market will be tighter than in 2022, which will increase the support for future price increases,” said an Asia-Pacific producer. The oversupply has already been reflected in the current price by the market, the current FOB Australia price is less than $400 per ton.”

WorsleyAlumina’s production exceeded its nameplate capacity of 4.6 million tonnes/year in FY2022.

South32, which operates the refinery, expects to maintain production levels in fiscal 2023.

Queensland Alumina and the Yarwun refinery on Australia’s east coast produced a combined 6.374 million tonnes in fiscal 2022, down from 6.798 million tonnes in fiscal 2021.

Alumina production at Alcoa World Alumina and Chemicals’ Pinjarra, Wagerup and Kwinana refineries in fiscal 2022 was 8.991 million tonnes, down from 9.577 million tonnes in the previous year.

Alumina Limited, which owns a 40% stake in AWAC, expects production to decline in fiscal year 2023 due to the impact of declining bauxite grades, interruptions in natural gas supply, and refinery maintenance.

But as caustic soda and bauxite prices have fallen sharply so far in 2023 from their 2022 peaks, one western consumer said Australian alumina prices could fall further from current levels. “China’s increasing alumina refining capacity will also continue to put pressure on prices, and the Chinese import arbitrage window will close when prices stabilize appropriately.”

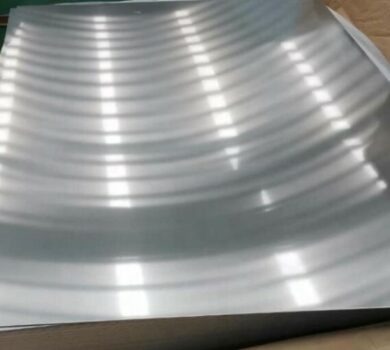

- Aluminium Coil

- Aluminum Profile, Aluminum Extrusion

- Aluminum Strip for Cap/Lid/Sealing

- Blogs

- Color Coated Aluminum Coil

- Contact Us

- Logistics case study

- Products overview

- Recruit

- Team

- Thank you for contacting us

- Thanks for contacting us

- Tianjin Yikuo Aluminum Foil

- Tracking report will be sent shortly

- Yk Aluminum

- YK Aluminum Sheet Plate

- YK Aluminum Stock

- YK Aluminum Strip

- YK Aviation Aluminum

- YK Factory

- YK Household Aluminum Foil

- YK Marine Grade Aluminum

Main Menu