Auto makers are still buying aluminum to make cars, but orders have fallen short of expectations, officials with the aluminum company said in an interview.

SteveFisher took over as CEO of Novelis last year, which makes more than half of the world’s aluminum sheets. SteveFisher says the market is a little ahead of its time.

When ford motor Co. announced a few years ago that its popular f-150 series would be metal-free, aluminum industry leaders predicted a flood of new orders.

But with metal makers quickly introducing lightweight metals to compete, and demand for lightweight cars hurt by falling oil prices, auto makers are hesitant about aluminum.

Customers now need a range of materials to make cars, says Mr Fisher.

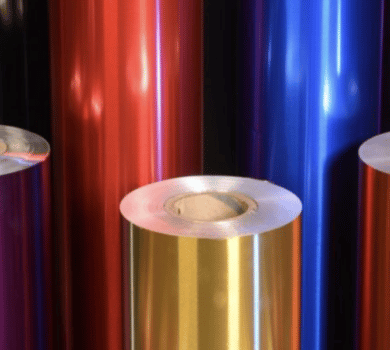

Novelis, owned by India’s Hindalco Industries Ltd., has made a big bet on auto aluminum, investing more than $550 million since 2011 to quadruple production and add five production lines to upgrade its upstate New York plant to meet f-150 demand.

Novelis produced 788,000 metric tons of rolled aluminum in the last quarter, a 4% increase from last year and a quarterly record.

Net income was $29 million, flat from a year earlier.

The company currently holds 50% of the global market share for aluminum automotive panels.

Mr Fisher says the firm still expects the car aluminium market to grow at a compound annual rate of 20% by 2020.

Lightweight is influenced by three factors: vehicle performance, global fuel economy regulations, and market appetite for electric vehicles.

Fisher added that Tesla Motors inc. has successfully built non-aluminum electric cars.